5 Questions To Ask At Best ACH Integration Options

Software developers are under pressure from competitors in their market space,

customers with “special needs,” and from their own company to constantly be innovating and taking their product to the next level.

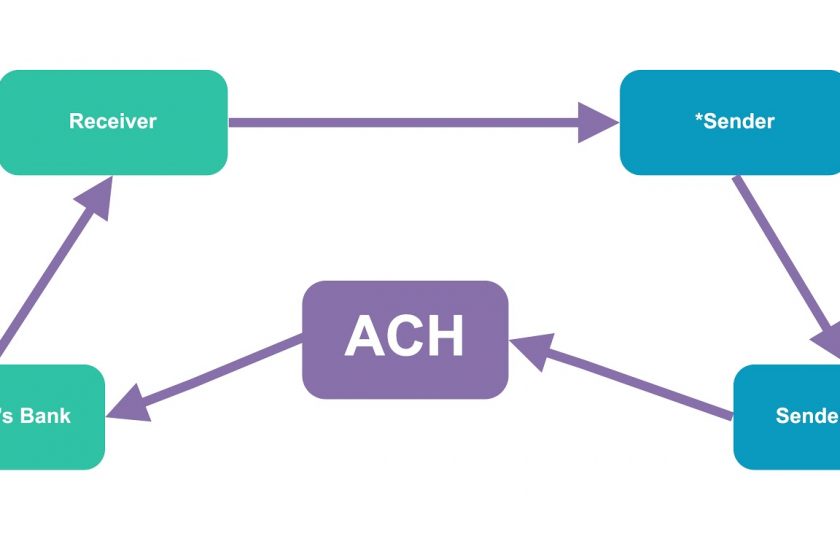

Integrating a payment processing solution offers end users the ability to debit/credit checking accounts, ACH Web payments ,savings accounts, or credit card accounts, AND provide methods to automatically post and reconcile payments.We are also read forWhy Is GIS Technology Important To Urban Planning?

What are the Best ACH Integration Options?

In terms of an ACH Integration API, the Best ACH Integration Options include:

- API availability: Does the partner offer RESTful or SOAP ACH transaction integration, or both?

- Is sensitive data tokenized?

- Does the platform meet PCI Security standards (though NACHA does not require ACH transactions to be PCI compliant)?

- Can risk acceptance models lower processing costs?

- Can you leverage the ACH Processing Integration for your apps’ revenue stream?

- For market bases that include Canada: does the partner provide a single API for both United States ACH and Canadian EFT?

- How long has your potential integration partner been serving the needs of app providers and what is their track record?

- Does the ACH API offer additional utilities to make calls for anti-fraud and risk mitigation?

- Are there white label possibilities that might allow for a branded processing option, keeping the ACH processor behind the scene?

- Other payment utilities available?

- Will your potential partner take the time to understand your business requirements and provide options that custom fit the payments needs to your needs and your clients?

- Does the partner provide assistance in ACH payments processing adoption for you and your user clients?

- Is there an API that would allow your customers to apply from your site or app?

The Best ACH Integration Options provides payment options and benefits for a SaaS company’s users. For Businesses that utilize a recurring payment model ACH Integration is an absolute necessity for multiple reasons:

- ACH payments are widely accepted for payment facilitation by both consumers and businesses.

- Credit card decline rates are on the rise. Average recurring credit card billing return rates are around 15%, while ACH payment processing return rates are typically sub 2%.

- ACH Processing fees are typically 80-90% less expensive than credit card fees.

- Banking checking and savings accounts don’t have expiration dates and are not nearly as susceptible to being closed or re-generated due to data theft, making ACH integration of payments an ideal choice for recurring payments based applications.